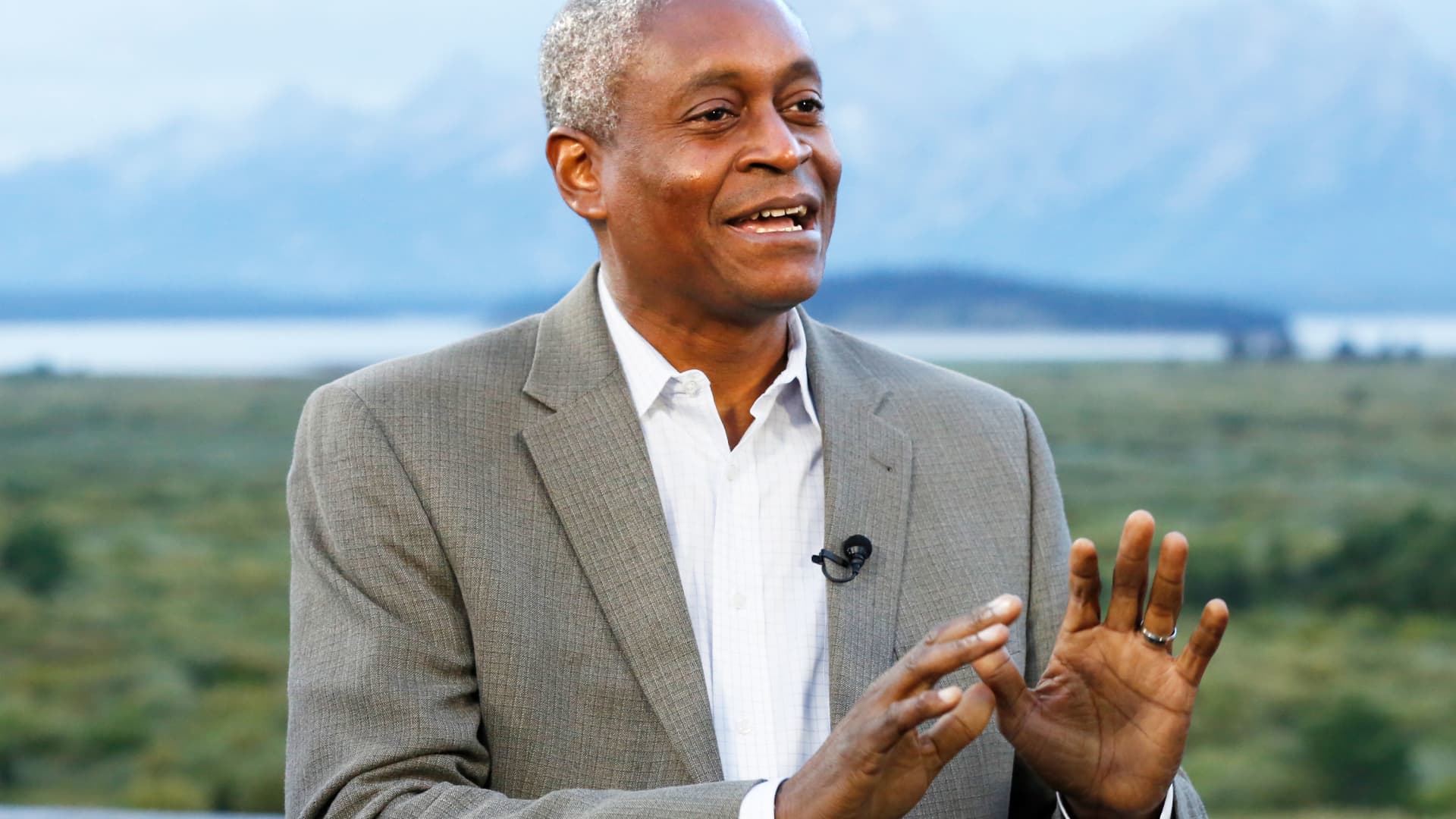

Atlanta Federal Reserve President Raphael Bostic expressed concern Wednesday in regards to the tempo of inflation and indicated he would not suppose rate of interest cuts ought to come till a lot later within the yr.

In a CNBC interview, the central financial institution official mentioned sturdy productiveness, a rebound within the provide chain and a resilient labor market are indicating that inflation goes to say no “a lot slower than what many have anticipated.”

“If the economic system evolves as I anticipate, and that is going to be seeing continued robustness in GDP, unemployment and a gradual decline of inflation by the course of the yr, I feel it could be applicable for us to do begin transferring down on the finish of this yr, the fourth quarter,” he mentioned on “Squawk Field.” “We’ll simply should see the place the info are available.”

Bostic’s feedback come as different Fed officers are also indicating a need to maneuver cautiously on charge cuts. They’ve indicated {that a} sturdy economic system in addition to moderating inflation give them time to see extra proof that inflation is transferring again to the central financial institution’s 2% goal.

Nonetheless, the steadiness of the Federal Open Market Committee, of which Bostic is a voting member, indicated final month that they see three cuts coming this yr, assuming quarter share level increments.

That makes Bostic one of many extra hawkish members of the rate-setting physique. Markets anticipate the Fed will begin chopping in June or July. The chance shifted Wednesday morning, with the market-implied chance of a June reduce sliced to 54%, down about 10 share factors from the day prior to this, in keeping with the CME Group’s FedWatch gauge.

Throughout Wednesday’s interview, Bostic indicated that his views on inflation and charges have swung forwards and backwards as he is watched the info evolve from optimistic progress on inflation within the latter a part of 2023 to much less sure footing this yr.

“The highway goes to be bumpy, and I feel in case you’ve appeared over the past a number of months, inflation hasn’t moved very a lot relative to the place we have been on the finish of 2023,” he mentioned. “There are some secondary measures within the inflation numbers which have gotten me a bit involved that issues might transfer even slower.”

There are some items elements in inflation metrics the Fed makes use of that present a excessive proportion transferring above 3% and a few even above 5%, he mentioned.

“These are a lot greater now than they have been earlier than and so they’re beginning to development again to what we noticed within the excessive inflation interval,” Bostic added. “They’re transferring away from what we would prefer to see. So I’ve acquired to make it possible for these aren’t hiding some further upward strain and pricing strain earlier than I’ll need to transfer our coverage charge.”

Most metrics the Atlanta Fed tracks present inflation operating above 3%. Its personal measure of “sticky” inflation confirmed the 12-month charge at 4.4% in February. Actually, the one measures within the Atlanta Fed’s “Underlying Inflation Dashboard” operating beneath 3% are the private consumption expenditures worth indexes that the central financial institution makes use of as its main gauge.