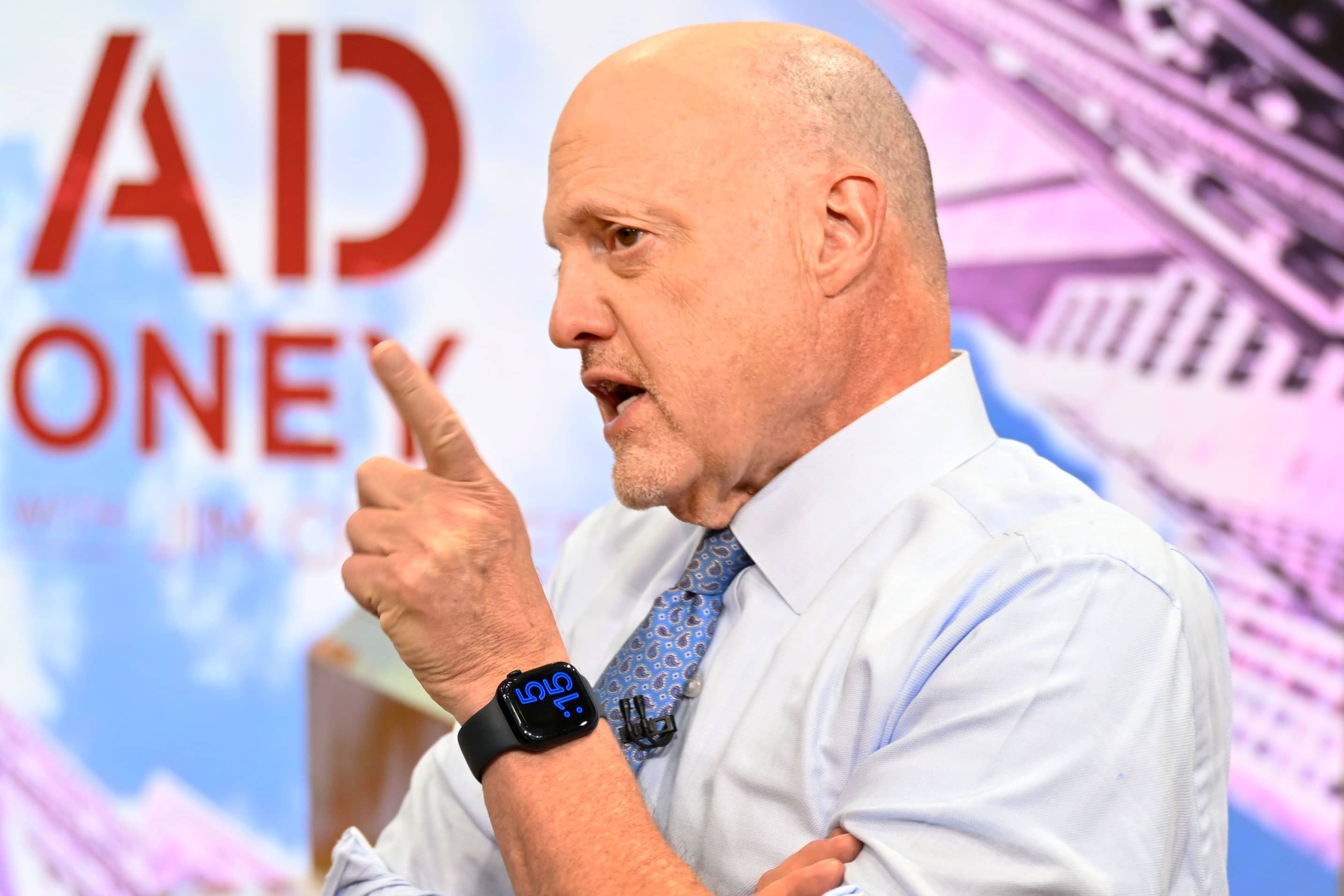

After a bitter day in Washington and on Wall Avenue, CNBC’s Jim Cramer warned traders that lawmakers will inevitably price them cash as debt ceiling negotiations drag on.

“Prepare for our legislators to lose you some extra money,” Cramer stated, referencing the sooner deadlock surrounding the debt ceiling in 2011. “They harm you then. They are not finished hurting you now. However until you commerce full time it’s totally onerous to get out and get again in early sufficient for it to make a distinction, which suggests most of us have to take the ache.”

associated investing information

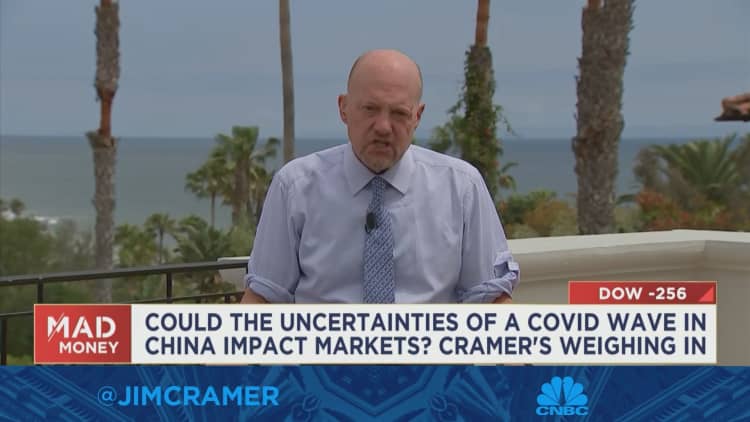

Market watchers are additionally weighing the information of the emergence of a brand new Covid-19 variant in China, he stated. It is unclear whether or not this new wave will immediate Beijing to impose new journey restrictions, lots of which eased up a number of months in the past.

“We do not know if journey shall be banned or restricted, though the Macau on line casino shares are buying and selling prefer it’s gonna occur,” Cramer stated. “And we do not know if the psyche of the not too long ago ebullient Chinese language shopper shall be impacted.”

With 2011’s fitful debt ceiling negotiations ringing in his ears, Cramer is pessimistic about lawmakers’ capability to come back to a deal earlier than chaos reigns.

“Though we finally obtained a deal [in 2011] and averted the worst-case state of affairs, the standoff was sufficient to make Customary & Poor’s downgrade our authorities’s credit standing,” he stated.

Cramer thought of the deserves of promoting shares earlier than the potential market swoon, however anxious that many will be unable to purchase them again quick sufficient to see actual good points.

“I’d hate to advise you to promote after which purchase again later, although, as a result of we do not know if you can get again in earlier than the all-clear,” Cramer remarked. “That stated, in case you suppose our leaders are severe about making a deal, then it is perhaps value making an attempt to sidestep the approaching decline — and if we’re following the 2011 script, there’d be a couple of 12% decline from right here till the underside.”