CNBC’s Jim Cramer mentioned on Friday that this week was the newest instance of the market gone loopy after a Federal Reserve assembly.

However based mostly on previous market reactions to the central financial institution’s earlier charge hikes, this week’s exercise could show to not be that significant in the long term, he mentioned.

The preliminary response to the Fed’s strikes is “nearly at all times a head pretend,” Cramer mentioned.

The market had an enormous response this week following the Fed’s newest transfer, Cramer famous — with a tough sell-off on Wednesday, adopted by a small comeback on Thursday and a chaotic session Friday. Whereas newfound turmoil within the European monetary sector dragged down shares early Friday, they recovered after these markets closed.

Following the central financial institution’s quarter level charge hike on Wednesday, there have been 9 will increase in simply over a yr.

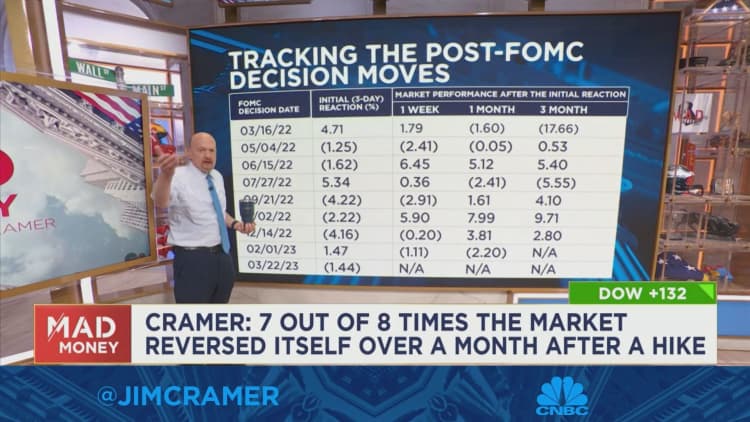

The market has tracked a sample through which — after the primary three days following a Fed resolution — it’ll normally go in the wrong way the following month, Cramer mentioned.

When wanting on the earlier eight charge hikes this cycle, the market reversed course over the next month seven out of eight instances. (There may be not sufficient information to run an evaluation on the February charge hike.)

The one exception was the second that occurred in early Could. That prompted a tough sell-off that lasted a number of days, and markets had been mainly flat within the month that adopted.

Typically, once you zoom out three months, the preliminary market strikes — whether or not they’re optimistic or damaging — are inclined to reverse themselves each time, Cramer mentioned.

The sample is simply too overwhelming to disregard, Cramer mentioned.

To make certain, it stays to be seen whether or not that very same sample will maintain this time, or whether or not the damaging preliminary response to the Fed’s transfer this week will reverse itself.

This time, with new emergencies cropping up virtually every single day, particularly within the banking sector, it “feels harmful” to foretell a rally over the following three months, Cramer mentioned.

However the backside line is, we have been right here earlier than, he careworn.

“So, take a deep breath, drink some tea and keep in mind that the preliminary response to the Fed’s charge hikes has been improper each time over the previous yr,” Cramer mentioned.